The 8-Second Trick For Hsmb Advisory Llc

The 8-Second Trick For Hsmb Advisory Llc

Blog Article

The Definitive Guide to Hsmb Advisory Llc

Table of ContentsSome Ideas on Hsmb Advisory Llc You Should KnowThe Definitive Guide for Hsmb Advisory LlcHsmb Advisory Llc Can Be Fun For EveryoneSome Known Incorrect Statements About Hsmb Advisory Llc The 6-Second Trick For Hsmb Advisory LlcOur Hsmb Advisory Llc PDFs

Ford states to guide clear of "cash worth or long-term" life insurance policy, which is even more of an investment than an insurance. "Those are very made complex, featured high commissions, and 9 out of 10 people do not require them. They're oversold because insurance coverage representatives make the biggest commissions on these," he states.

Handicap insurance policy can be expensive. And for those that opt for long-lasting care insurance policy, this plan may make disability insurance policy unneeded. Find out more about lasting care insurance and whether it's best for you in the following section. Long-term treatment insurance can assist pay for costs associated with long-lasting treatment as we age.

Hsmb Advisory Llc Fundamentals Explained

If you have a chronic wellness concern, this kind of insurance coverage might wind up being critical (St Petersburg, FL Health Insurance). Nonetheless, do not allow it emphasize you or your checking account early in lifeit's normally best to obtain a policy in your 50s or 60s with the anticipation that you will not be using it up until your 70s or later.

If you're a small-business proprietor, take into consideration shielding your resources by buying service insurance policy. In the event of a disaster-related closure or duration of rebuilding, service insurance policy can cover your income loss. Take into consideration if a significant climate occasion influenced your shop or manufacturing facilityhow would that affect your earnings?

And also, making use of insurance might occasionally set you back greater than it conserves in the lengthy run. If you get a chip in your windshield, you might take into consideration covering the fixing expenditure with your emergency financial savings instead of your car insurance. Why? Due to the fact that using your automobile insurance policy can create your monthly costs to go up.

Hsmb Advisory Llc for Dummies

Share these tips to secure enjoyed ones from being both underinsured and overinsuredand seek advice from a trusted expert when required. (https://forums.hostsearch.com/member.php?256834-hsmbadvisory)

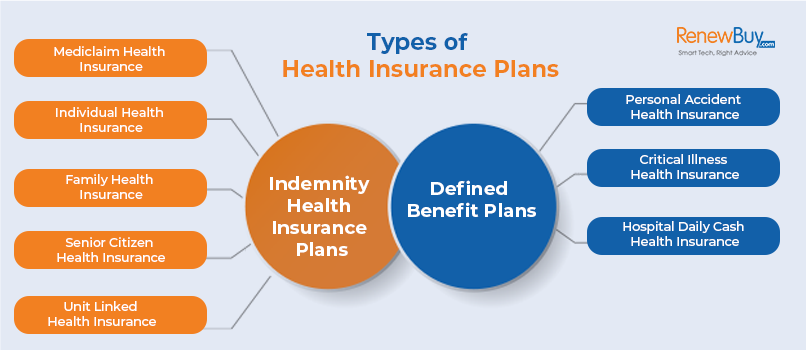

Insurance coverage that is purchased by a private for single-person insurance coverage or coverage of a household. The specific pays the costs, as opposed to employer-based medical insurance where the employer usually pays a share of the costs. Individuals may buy and purchase insurance coverage from any kind of plans readily available in the person's geographical area.

People and households might qualify for economic help to reduce the price of insurance premiums and out-of-pocket costs, however only when signing up through Link for Health Colorado. If you experience certain adjustments in your life,, you are eligible for a 60-day period of time where you can enroll in a specific strategy, also if it is outside of the annual open enrollment period of Nov.

15.

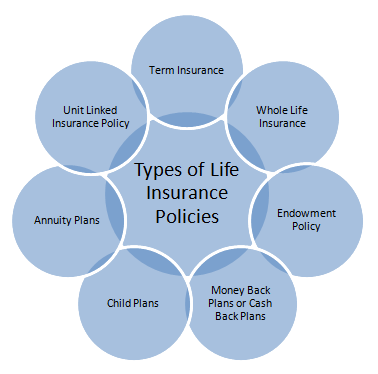

It may seem easy however recognizing insurance policy kinds can additionally be confusing. Much of this complication originates from the insurance sector's continuous goal to develop personalized coverage for insurance holders. In designing versatile plans, there are a variety to choose fromand all of those insurance coverage kinds can make it difficult to understand what a certain plan is and does.

Rumored Buzz on Hsmb Advisory Llc

If you die throughout this duration, the person or individuals you have actually named as recipients might get the cash anchor money payout of the policy.

Numerous term life insurance policies allow you transform them to a whole life insurance plan, so you do not lose coverage. Generally, term life insurance policy costs payments (what you pay each month or year into your policy) are not locked in at the time of purchase, so every 5 or 10 years you have the plan, your costs might climb.

They also tend to be less expensive overall than whole life, unless you get a whole life insurance policy plan when you're young. There are also a couple of variants on term life insurance policy. One, called group term life insurance policy, prevails among insurance policy choices you may have accessibility to via your employer.

Some Ideas on Hsmb Advisory Llc You Should Know

One more variant that you might have access to via your employer is supplemental life insurance coverage., or burial insuranceadditional coverage that could help your family members in situation something unforeseen happens to you.

Permanent life insurance merely refers to any type of life insurance coverage plan that doesn't run out.

Report this page